16 Corporate Finance

What is Finance?

Finance is the study of the management, movement, and raising of money. The word finance can be used as a verb, such as when a bank agrees to finance a home mortgage loan. It can also be used as a noun referring to an entire industry. At its essence, the study of finance is about understanding the sources and uses of cash, as well as the concept of risk-reward tradeoff.

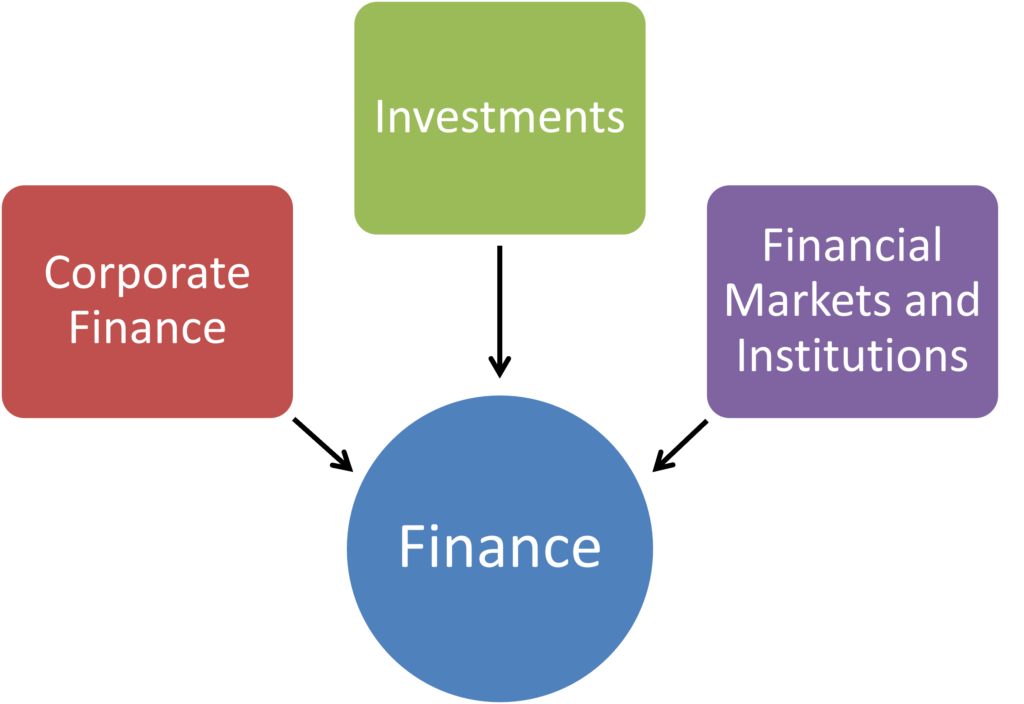

Finance is divided into three primary areas: corporate finance, investments, and financial markets and institutions (Figure 16.1). Corporate finance is the focus of this chapter, investments will be covered in Chapter 17, and financial markets were covered in Chapter 2.

The Role of Finance in an Organization

Any company, whether it’s a small-town bakery or General Motors, needs money to operate. To make money, it must first spend money—on inventory and supplies, equipment and facilities, and employee wages and salaries. Therefore, finance is critical to the success of all companies. It may not be as visible as marketing or production, but management of a firm’s finances is just as much a key to the firm’s success.

Financial management—the art and science of managing a firm’s money so that it can meet its goals—is not just the responsibility of the finance department. All business decisions have financial consequences. Managers in all departments must work closely with financial personnel. If you are a sales representative, for example, the company’s credit and collection policies will affect your ability to make sales. The head of the IT department will need to justify any requests for new computer systems or employee laptops.

Revenues from sales of the firm’s products should be the chief source of funding. But money from sales doesn’t always come in when it’s needed to pay the bills. Financial managers must track how money is flowing into and out of the firm (Figure 16.2). They work with the firm’s other department managers to determine how available funds will be used and how much money is needed. Then they choose the best sources to obtain the required funding.

For example, a financial manager will track day-to-day operational data such as cash collections and disbursements to ensure that the company has enough cash to meet its obligations. Over a longer time horizon, the manager will thoroughly study whether and when the company should open a new manufacturing facility. The manager will also suggest the most appropriate way to finance the project, raise the funds, and then monitor the project’s implementation and operation.

Financial management is closely related to accounting. In most firms, both areas are the responsibility of the vice president of finance or chief financial officer (CFO). But the accountant’s main function is to collect and present financial data. Financial managers use financial statements and other information prepared by accountants to make financial decisions. Financial managers focus on cash flows, the inflows and outflows of cash. They plan and monitor the firm’s cash flows to ensure that cash is available when needed.

The Financial Manager’s Responsibilities and Activities

Financial managers have a complex and challenging job. They analyze financial data prepared by accountants, monitor the firm’s financial status, and prepare and implement financial plans. One day they may be developing a better way to automate cash collections, and the next they may be analyzing a proposed acquisition. The key activities of the financial manager are:

- Financial planning: Preparing the financial plan, which projects revenues, expenditures, and financing needs over a given period.

- Investment (spending money): Investing the firm’s funds in projects and securities that provide high returns in relation to their risks.

- Financing (raising money): Obtaining funding for the firm’s operations and investments and seeking the best balance between debt (borrowed funds) and equity (funds raised through the sale of ownership in the business).

The Goal of the Financial Manager

How can financial managers make wise planning, investment, and financing decisions? An important goal of the financial manager is to maximize the value of the firm for its owners. The value of a publicly owned corporation is measured by the share price of its stock. A private company’s value is the price at which it could be sold.

To maximize the firm’s value, the financial manager has to consider both short- and long-term consequences of the firm’s actions. Maximizing profits is one approach, but it should not be the only one. Such an approach favors making short-term gains over achieving long-term goals. What if a firm in a highly technical and competitive industry did no research and development? In the short run, profits would be high because research and development is very expensive. But in the long run, the firm might lose its ability to compete because of its lack of new products.

This is true regardless of a company’s size or point in its life cycle. At Corning, a company founded more than 160 years ago, management believes in taking the long-term view and not managing for quarterly earnings to satisfy Wall Street’s expectations. The company, once known to consumers mostly for kitchen products such as Corelle dinnerware and Pyrex heat-resistant glass cookware, is today a technology company that manufactures specialized glass and ceramic products. It is a leading supplier of Gorilla Glass, a special type of glass used for the screens of mobile devices, including the iPhone, the iPad, and devices powered by Google’s Android operating system. The company was also the inventor of optical fiber and cable for the telecommunications industry. These product lines require large investments during their long research and development (R&D) cycles and for plant and equipment once they go into production.[1]

As the Corning situation demonstrates, financial managers constantly strive for a balance between the opportunity for profit and the potential for loss. In finance, the opportunity for profit is termed return; the potential for loss, or the chance that an investment will not achieve the expected level of return, is risk. A basic principle in finance is that the higher the risk, the greater the return that is required (Figure 16.3). This widely accepted concept is called the risk-return tradeoff. Financial managers consider many risk and return factors when making investment and financing decisions. Among them are changing patterns of market demand, interest rates, general economic conditions, market conditions, and social issues (such as environmental effects and equal employment opportunity policies).

How Organizations Use Funds

To grow and prosper, a firm must keep investing money in its operations. The financial manager decides how best to use the firm’s money. Short-term expenses support the firm’s day-to-day activities. For instance, athletic-apparel maker Nike regularly spends money to buy such raw materials as leather and fabric and to pay employee salaries. Long-term expenses, also referred to as capital expenditures, are typically for fixed assets. For Nike, these would include outlays to build a new factory, buy automated manufacturing equipment, or acquire a small manufacturer of sports apparel.

Short-Term Expenses

Short-term expenses are outlays used to support current production and selling activities. They typically result in current assets, which include cash and any other assets (accounts receivable and inventory) that can be converted to cash within a year. The financial manager’s goal is to manage current assets so the firm has enough cash to pay its bills and to support its accounts receivable and inventory.

Cash

Cash is the lifeblood of business. Without it, a firm could not operate. An important duty of the financial manager is cash management, or making sure that enough cash is on hand to pay bills as they come due and to meet unexpected expenses.

Businesses estimate their cash requirements for a specific period. Many companies keep a minimum cash balance to cover unexpected expenses or changes in projected cash flows. The financial manager arranges loans to cover any shortfalls. If the size and timing of cash inflows closely match the size and timing of cash outflows, the company needs to keep only a small amount of cash on hand. A company whose sales and receipts are fairly predictable and regular throughout the year needs less cash than a company with a seasonal pattern of sales and receipts. A toy company, for instance, whose sales are concentrated in the fall, spends a great deal of cash during the spring and summer to build inventory. It has excess cash during the winter and early spring, when it collects on sales from its peak selling season.

Because cash held in checking accounts earns little, if any, interest, the financial manager tries to keep cash balances low and to invest the surplus cash. Surpluses are invested temporarily in marketable securities, short-term investments that are easily converted into cash. The financial manager looks for low-risk investments that offer high returns. Three of the most popular marketable securities are Treasury bills, certificates of deposit, and commercial paper. Today’s financial managers have new tools to help them find the best short-term investments, such as online trading platforms that save time and provide access to more types of investments. These have been especially useful for smaller companies who don’t have large finance staffs.

In addition to seeking the right balance between cash and marketable securities, the financial manager tries to shorten the time between the purchase of inventory or services (cash outflows) and the collection of cash from sales (cash inflows). The three key strategies are to collect money owed to the firm (accounts receivable) as quickly as possible, to pay money owed to others (accounts payable) as late as possible without damaging the firm’s credit reputation, and to minimize the funds tied up in inventory.

Accounts Receivable

Accounts receivable represent sales for which the firm has not yet been paid. Because the product has been sold but cash has not yet been received, an account receivable amounts to a use of funds. For the average manufacturing firm, accounts receivable represent about 15 to 20 percent of total assets.

The financial manager’s goal is to collect money owed to the firm as quickly as possible, while offering customers credit terms attractive enough to increase sales. Accounts receivable management involves setting credit policies, guidelines on offering credit, credit terms, and specific repayment conditions, including how long customers have to pay their bills and whether a cash discount is given for quicker payment. Another aspect of accounts receivable management is deciding on collection policies, the procedures for collecting overdue accounts.

Inventory

Another use of funds is to buy inventory needed by the firm (Figure 16.4). In a typical manufacturing firm, inventory is nearly 20 percent of total assets. The cost of inventory includes not only its purchase price, but also ordering, handling, storage, interest, and insurance costs.

Production, marketing, and finance managers usually have differing views about inventory. Production managers want lots of raw materials on hand to avoid production delays. Marketing managers want lots of finished goods on hand so customer orders can be filled quickly. But financial managers want the least inventory possible without harming production efficiency or sales. Financial managers must work closely with production and marketing to balance these conflicting goals.

Long-Term Expenses

A firm also invests funds in physical assets such as land, buildings, machinery, equipment, and information systems. These are called capital expenditures. Unlike operating expenses, which produce benefits within a year, the benefits from capital expenditures extend beyond one year. For instance, a printer’s purchase of a new printing press with a usable life of seven years is a capital expenditure and appears as a fixed asset on the firm’s balance sheet. Paper, ink, and other supplies, however, are expenses. Mergers and acquisitions are also considered capital expenditures.

Firms make capital expenditures for many reasons. The most common are to expand, to replace or renew fixed assets, and to develop new products. Most manufacturing firms have a big investment in long-term assets. Boeing Company, for instance, puts billions of dollars a year into airplane-manufacturing facilities. Because capital expenditures tend to be costly and have a major effect on the firm’s future, the financial manager uses a process called capital budgeting to analyze long-term projects and select those that offer the best returns while maximizing the firm’s value. Decisions involving new products or the acquisition of another business are especially important. Managers look at project costs and forecast the future benefits the project will bring to calculate the firm’s estimated return on the investment.

Obtaining Financing

How do firms raise the funds they need? They borrow money (debt), sell ownership shares (equity), and retain earnings (profits). The financial manager must assess all these sources and choose the one most likely to help maximize the firm’s value.

Short-term Financing

Like expenses, borrowed funds can be divided into short- and long-term loans. A short-term loan comes due within one year; a long-term loan has a maturity greater than one year. Short-term financing is shown as a current liability on the balance sheet and is used to finance current assets and support operations. Short-term loans can be unsecured or secured.

Unsecured loans are made on the basis of the firm’s creditworthiness and the lender’s previous experience with the firm. An unsecured borrower does not have to pledge specific assets as security.

Secured loans require the borrower to pledge specific assets as collateral, or security. The secured lender can legally take the collateral if the borrower doesn’t repay the loan. Commercial banks and commercial finance companies are the main sources of secured short-term loans to business. Borrowers whose credit is not strong enough to qualify for unsecured loans use these loans.

Long-term Financing

A basic principle of finance is to match the term of the financing to the period over which benefits are expected to be received from the associated outlay. Short-term items should be financed with short-term funds, and long-term items should be financed with long-term funds. Long-term financing sources include both debt (borrowing) and equity (ownership). Equity financing comes either from selling new ownership interests or from retaining earnings. Financial managers try to select the mix of long-term debt and equity that results in the best balance between cost and risk.

Debt versus Equity Financing

Say that the Boeing Company plans to spend $2 billion over the next four years to build and equip new factories to make jet aircraft. Boeing’s top management will assess the pros and cons of both debt and equity and then consider several possible sources of the desired form of long-term financing.

The major advantage of debt financing is the deductibility of interest expense for income tax purposes, which lowers its overall cost. In addition, there is no loss of ownership. The major drawback is financial risk: the chance that the firm will be unable to make scheduled interest and principal payments. The lender can force a borrower that fails to make scheduled debt payments into bankruptcy. Most loan agreements have restrictions to ensure that the borrower operates efficiently.

Equity, on the other hand, is a form of permanent financing that places few restrictions on the firm. The firm is not required to pay dividends or repay the investment. However, equity financing gives common stockholders voting rights that provide them with a voice in management. Equity is more costly than debt. Unlike the interest on debt, dividends to owners are not tax-deductible expenses. Table 16.1 summarizes the major differences between debt and equity financing.

| Debt Financing | Equity Financing | |

| Ability to influence management | Creditors typically have none, unless the borrower defaults on payments. Creditors may be able to place restraints on management in event of default. | Common stockholders have voting rights. |

| A claim on income and assets | Debt holders rank ahead of equity holders. Payment of interest and principal is a contractual obligation of the firm. | Equity owners have a residual claim on income (dividends are paid only after paying interest and any scheduled principal) and no obligation to pay dividends. |

| Maturity (date when debt needs to be paid back) | Debt has a stated maturity and requires repayment of principal by a specified date. | The company is not required to repay equity, which has no maturity date. |

| Tax treatment | Interest is a tax-deductible expense. | Dividends are not tax-deductible and are paid from after-tax income. |

Debt Financing

Long-term debt is used to finance long-term (capital) expenditures. The initial maturities of long-term debt typically range between 5 and 20 years. Three important forms of long-term debt are term loans, bonds, and mortgage loans.

A term loan is a business loan with a maturity of more than one year. Term loans generally have maturities of 5 to 12 years and can be unsecured or secured. They are available from commercial banks, insurance companies, pension funds, commercial finance companies, and manufacturers’ financing subsidiaries. A contract between the borrower and the lender spells out the amount and maturity of the loan, the interest rate, payment dates, the purpose of the loan, and other provisions such as operating and financial restrictions on the borrower to control the risk of default. The payments include both interest and principal, so the loan balance declines over time. Borrowers try to arrange a repayment schedule that matches the forecast cash flow from the project being financed.

Bonds are long-term debt obligations (liabilities) of corporations and governments. A bond certificate is issued as proof of the obligation. The issuer of a bond must pay the buyer a fixed amount of money—called interest, stated as the coupon rate—on a regular schedule, typically every six months. The issuer must also pay the bondholder the amount borrowed—called the principal, or par value—at the bond’s maturity date (due date). Bonds are usually issued in units of $1,000—for instance, $1,000, $5,000, or $10,000—and have initial maturities of 10 to 30 years. They may be secured or unsecured, include special provisions for early retirement, or be convertible to common stock.

A mortgage loan is a long-term loan made against real estate as collateral. The lender takes a mortgage on the property, which lets the lender seize the property, sell it, and use the proceeds to pay off the loan if the borrower fails to make the scheduled payments. Long-term mortgage loans are often used to finance office buildings, factories, and warehouses.

Equity Financing

Equity refers to the owners’ investment in the business. In corporations, the preferred and common stockholders are the owners. A firm obtains equity financing by selling new ownership shares (external financing), by retaining earnings (internal financing), or for small and growing, typically high-tech, companies, through venture capital (external financing).

Selling New Issues of Common Stock

Common stock is a security that represents an ownership interest in a corporation. A company’s first sale of stock to the public is called an initial public offering (IPO) (Figure 16.5). An IPO often enables existing stockholders, usually employees, family, and friends who bought the stock privately, to earn big profits on their investment. Companies that are already public can issue and sell additional shares of common stock to raise equity funds.

But going public has some drawbacks. For one thing, there is no guarantee an IPO will sell. It is also expensive. Big fees must be paid to investment bankers, brokers, attorneys, accountants, and printers. Once the company is public, it is closely watched by regulators, stockholders, and securities analysts. The firm must reveal such information as operating and financial data, product details, financing plans, and operating strategies. Providing this information is often costly.

Going public is the dream of many small company founders and early investors, who hope to recoup their investments and become instant millionaires. However, some companies choose to remain private. Cargill, SC Johnson, Mars, Publix Super Markets, and Bloomberg are among the largest U.S. private companies.

Dividends and Retained Earnings

Dividends are payments to stockholders from a corporation’s profits. Dividends can be paid in cash or in stock. Stock dividends are payments in the form of more stock. Stock dividends may replace or supplement cash dividends. After a stock dividend has been paid, more shares have a claim on the same company, so the value of each share often declines. A company does not have to pay dividends to stockholders. But if investors buy the stock expecting to get dividends and the firm does not pay them, the investors may sell their stocks.

At their quarterly meetings, the company’s board of directors (typically with the advice of its CFO) decides how much of the profits to distribute as dividends and how much to reinvest. A firm’s basic approach to paying dividends can greatly affect its share price. A stable history of dividend payments indicates good financial health.

If a firm that has been making regular dividend payments cuts or skips a dividend, investors start thinking it has serious financial problems. The increased uncertainty often results in lower stock prices. Thus, most firms set dividends at a level they can keep paying. They start with a relatively low dividend payout ratio so that they can maintain a steady or slightly increasing dividend over time.

Retained earnings, profits that have been reinvested in the firm, have a big advantage over other sources of equity capital: They do not incur underwriting costs. Financial managers strive to balance dividends and retained earnings to maximize the value of the firm. Often the balance reflects the nature of the firm and its industry. Well-established and stable firms and those that expect only modest growth, such as public utilities, financial services companies, and large industrial corporations, typically pay out much of their earnings in dividends.

Most high-growth companies, such as those in technology-related fields, finance much of their growth through retained earnings and pay little or no dividends to stockholders. As they mature, many decide to begin paying dividends, as Apple decided to do in 2012, after 17 years of paying no annual dividends to shareholders.[2]

Preferred Stock

Another form of equity is preferred stock. Unlike common stock, preferred stock usually has a dividend amount that is set at the time the stock is issued. These dividends must be paid before the company can pay any dividends to common stockholders. Also, if the firm goes bankrupt and sells its assets, preferred stockholders get their money back before common stockholders do.

Like debt, preferred stock increases the firm’s financial risk because it obligates the firm to make a fixed payment. But preferred stock is more flexible. The firm can miss a dividend payment without suffering the serious results of failing to pay back a debt.

Preferred stock is more expensive than debt financing, however, because preferred dividends are not tax-deductible. Also, because the claims of preferred stockholders on income and assets are second to those of debtholders, preferred stockholders require higher returns to compensate for the greater risk.

Venture Capital

Venture capital is another source of equity capital. It is most often used by small and growing firms that aren’t big enough to sell securities to the public. This type of financing is especially popular among high-tech companies that need large sums of money.

Venture capitalists invest in new businesses in return for part of the ownership, sometimes as much as 60 percent. They look for new businesses with high growth potential, and they expect a high investment return within 5 to 10 years. By getting in on the ground floor, venture capitalists buy stock at a very low price. They earn profits by selling the stock at a much higher price when the company goes public. Venture capitalists generally get a voice in management through seats on the board of directors. Getting venture capital is difficult, even though there are hundreds of private venture-capital firms in this country. Most venture capitalists finance only about one to five percent of the companies that apply.

Chapter Review

Optional Resources to Learn More

| Articles | |

| “What is Risk?” https://www.investor.gov/introduction-investing/investing-basics/what-risk | |

| Books | |

| Finance People: An Introduction to Their World and How They Think by Michael Schill | |

| Principles of Finance (free textbook) https://openstax.org/details/books/principles-finance | |

| Podcasts | |

| The Better Finance Podcast https://www.ey.com/en_us/podcasts/better-finance-podcast-series | |

| Videos | |

| Introduction to Corporate Finance https://youtu.be/5eGRi66iUfU | |

| Websites | |

| Corporate Finance Institute https://corporatefinanceinstitute.com/resources/ |

Chapter Attribution

This chapter incorporates material from the following sources:

Chapter 16 of Gitman, L. J., McDaniel, C., Shah, A., Reece, M., Koffel, L., Talsma, B., & Hyatt, J. C. (2018). Introduction to business. OpenStax. https://openstax.org/books/introduction-business/pages/16-introduction. Licensed with CC BY 4.0.

Chapter 1 of Dahlquist, J. & Rainford, K. (2022). Principles of finance. OpenStax. https://openstax.org/books/principles-finance/pages/1-1-what-is-finance. Licensed with CC BY 4.0.

Media Attributions

Figure 16.4: Atomic Taco. Ikea self serve warehouse. [Image]. Wikimedia Commons. https://commons.wikimedia.org/wiki/File:Ikea_Self_Serve_Warehouse_(32682177920).jpg. Licensed with CC BY-SA 2.0.

Figure 16.5: SDCSteve. SmileDirectClub rings the Nasdaq bell. [Image]. Wikimedia Commons. https://commons.wikimedia.org/wiki/File:SmileDirectClub_Rings_the_Nasdaq_Bell_1.jpg. Licensed with CC BY-SA 2.0.

- Pisano, G. P. (2015). You need an innovation strategy. Harvard Business Review. https://hbr.org/2015/06/you-need-an-innovation-strategy ↵

- Vascellaro, J. E. (2012, March 21. Apple pads investor wallets. The Wall Street Journal. https://www.wsj.com/articles/SB10001424052702304724404577291071289857802. ↵

The art and science of managing a firm’s money so that it can meet its goals.

The inflows and outflows of cash.

In finance, the opportunity for profit.

In finance, the potential for loss, or the chance that an investment will not achieve the expected level of return.

A basic principle in finance which states that the higher the risk, the greater the return that is required.

Outlays used to support current production and selling activities.

Making sure that enough cash is on hand to pay bills as they come due and to meet unexpected expenses.

Temporary investments of excess cash that can readily be converted to cash.

Short-term debt obligations of one year or less issued by the US government.

Savings products offered by banks and credit unions. You generally agree to keep your money in the CD without taking a withdrawal for a specified length of time. Withdrawing money early means paying a penalty fee to the bank.

Unsecured short-term debt—an IOU—issued by a financially strong corporation.

Amounts owed to the firm by customers who bought goods or services on credit.

Stock of goods being held for production or for sale to customers.

A major expenditure that requires a large up-front investment and is expected to generate substantial cash inflow in return.

The process of determining which long-term or fixed assets to acquire in an effort to maximize shareholder value.

Loans that do not require assets as security and that are are made on the basis of the firm’s creditworthiness and the lender’s previous experience with the firm.

Loans that require the borrower to pledge specific assets as collateral, or security.

The chance that the firm will be unable to make scheduled interest and principal payments.

A business loan with a maturity of more than one year.

Long-term debt obligations (liabilities) of corporations and governments.

The amount of money that is paid by a borrower to a lender for the use of their money, typically calculated from an annualized rate.

The amount of annual interest paid by the bond issuer; is multiplied by the face value of a bond to determine annual interest or coupon payment amounts.

The amount borrowed by the issuer of a bond; also called par value.

A long-term loan made against real estate as collateral.

A security that represents an ownership interest in a corporation.

Process by which a company lists its ownership shares on a public stock exchange.

Payments to stockholders from a corporation’s profits.

Dividend payments in the form of more stock.

The amounts left over from profitable operations since the firm’s beginning; equal to total profits minus all dividends paid to stockholders.

An equity security for which the dividend amount is set at the time the stock is issued and the dividend must be paid before the company can pay dividends to common stockholders.

Financing obtained from venture capitalists, investment firms that specialize in financing small, high-growth companies and receive an ownership interest and a voice in management in return for their money.